How to Automate Your Finances for Stress-Free Saving

How to Automate Your Finances for Stress-Free Saving

Most people fail at saving money not because they lack discipline. They fail because they rely on willpower.

Willpower is a finite resource. By Wednesday evening, after a long workday and a frustrating commute, the idea of manually transferring $200 to a savings account feels about as appealing as a root canal. So it doesn’t happen - week after week.

Automation solves this problem entirely. According to a 2023 study by Vanguard, participants who automated their retirement contributions saved an average of 73% more than those who made manual deposits. The behavioral economics research is clear: removing friction from positive financial behaviors dramatically increases follow-through rates.

This article breaks down the exact systems and strategies financial professionals recommend for building a hands-off money management system.

The Foundation: Automated Income Allocation

The most effective automation happens before money ever hits a checking account.

Direct deposit splitting allows employees to route portions of each paycheck to multiple accounts simultaneously. A 2022 Bank of America survey found that only 34% of workers take advantage of this feature, despite most employers offering it at no cost.

The recommended approach involves setting up at least three deposit destinations:

Primary checking account: Cover fixed monthly expenses plus a 10-15% buffer. This account handles rent, utilities, insurance, and subscriptions. Keep it lean.

Dedicated savings account: Financial planners typically suggest routing 15-20% of gross income here. A separate bank entirely works best-the slight inconvenience of transferring funds back creates just enough friction to discourage impulse withdrawals.

Retirement account: Max employer match contributions first. Always. Leaving matching funds on the table is literally declining free money. According to Financial Engines research, American workers forfeit approximately $24 billion annually in unclaimed 401(k) matches.

The specific percentages matter less than the automation itself. Starting with a 5% automatic savings rate beats a theoretical 20% rate that never gets useed.

Bill Pay Automation: Beyond the Basics

Automatic bill pay has existed for decades. Yet a surprising number of people still manually pay recurring expenses each month.

The hesitation usually stems from fear of overdrafts or a desire to “stay on top” of spending. Both concerns have straightforward solutions.

Timing synchronization matters enormously. Schedule all automated payments within 3-5 days after the typical payday. this makes sure funds are available while maintaining predictable cash flow. Most billers allow payment date customization-take the fifteen minutes to align everything.

Buffer accounts provide overdraft protection without the predatory fees. Keep $500-1,000 in a linked savings account designated specifically as an emergency buffer. Some banks offer automatic overdraft transfers between accounts for free.

What should be automated? Everything recurring:

- Mortgage or rent (many landlords now accept ACH)

- Utilities (electric, gas, water, internet)

- Insurance premiums (auto, home, health)

- Subscriptions (streaming, software, memberships)

- Minimum credit card payments

- Investment contributions

One category deserves special attention: credit card payments. Setting up autopay for the full statement balance-not the minimum-prevents interest charges from accumulating. For those unable to pay in full, automating more than the minimum creates gradual debt reduction without requiring monthly decisions.

Investment Automation and Dollar-Cost Averaging

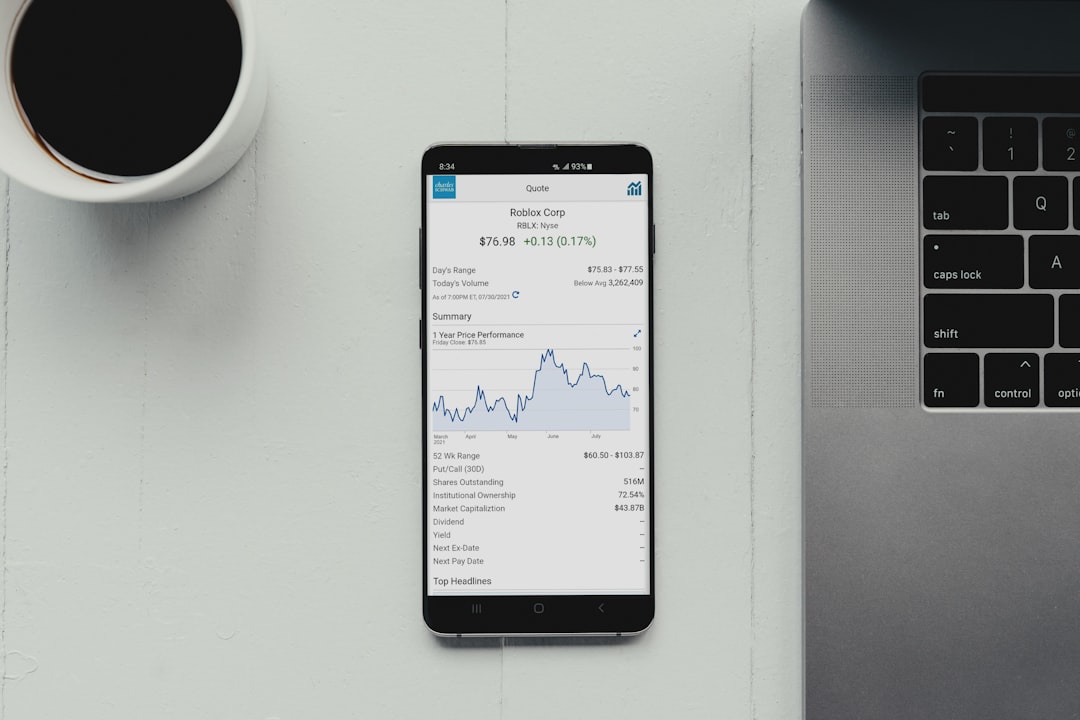

Brokerage accounts offer automation features that many investors overlook entirely.

Dollar-cost averaging-investing fixed amounts at regular intervals regardless of market conditions-removes emotional decision-making from the equation. During the March 2020 market crash, investors using automated investment plans continued buying throughout the decline. Those making manual decisions often panicked and sold at the worst possible moment.

The math supports this approach. A Morningstar analysis comparing lump-sum investing versus dollar-cost averaging found. While lump-sum technically outperforms roughly 68% of the time, the psychological benefits of automation led to better actual outcomes for most retail investors. People stick with automated plans. They abandon manual strategies when markets get volatile.

Setting up investment automation typically involves:

- Establishing a recurring transfer from checking to brokerage (weekly or bi-weekly works well)

- Creating automatic purchase orders for target funds or ETFs

Robo-advisors like Betterment, Wealthfront, and Schwab Intelligent Portfolios automate portfolio rebalancing and tax-loss harvesting as well. The 0. 25% annual fee common among these platforms often pays for itself through improved tax efficiency.

The FIRE Movement’s Automation Framework

Financial Independence, Retire Early practitioners have refined automation to an art form.

The typical FIRE automation stack includes several components working together:

Savings rate optimization: FIRE adherents often automate 50-70% of income toward investments. They accomplish this by calculating essential expenses precisely, then automating everything above that threshold toward wealth-building accounts.

Sub-account allocation: Many use multiple savings accounts for specific goals-emergency fund, travel, vehicle replacement, home down payment. Automated transfers fund each category proportionally.

Spending account isolation: Some practitioners use a “vault” system where the checking account accessible for daily spending receives only a predetermined allowance. The rest gets locked away automatically before temptation strikes.

Mr. Money Mustache, a prominent FIRE blogger, estimates that automation increased his personal savings rate by roughly 12 percentage points. “The money I never see is money I never miss,” he wrote in a widely-shared post on the topic.

Common Automation Mistakes to Avoid

Automation isn’t entirely set-and-forget - several pitfalls trap the unwary.

Failing to review annually: Circumstances change. A raise, new expense, or shifting priorities should trigger automation adjustments. Block one hour yearly for a comprehensive review.

Over-automating credit cards: Autopay for the statement balance works beautifully-until an unexpected charge or fraudulent transaction inflates the bill. Monitor statements monthly even with autopay enabled.

Ignoring account fees: Some savings accounts charge monthly maintenance fees that erode the very savings being accumulated. High-yield online savings accounts from institutions like Marcus, Ally, or Discover typically offer no fees with competitive interest rates.

Forgetting about inflation: An automated savings amount set five years ago may no longer represent the same percentage of income. Increase automated transfers proportionally after raises.

useation: A 30-Day Action Plan

Week one focuses on analysis - track where money currently goes. Identify all recurring expenses and their due dates. List every account-checking, savings, investment, retirement.

Week two involves architecture. Set up necessary accounts (high-yield savings, additional checking if needed). Contact HR about direct deposit splitting. Choose a bill pay consolidation approach.

Week three executes the automation - schedule all bill payments. Establish recurring transfers between accounts - set up investment auto-purchases.

Week four tests the system - monitor for issues. Adjust timing or amounts as needed. Document the complete automation framework for future reference.

The upfront time investment typically runs 4-8 hours total. The ongoing maintenance requires perhaps 15-30 minutes monthly.

The Psychology of Automated Wealth Building

Behavioral finance research consistently demonstrates that humans make poor financial decisions under emotional pressure. Fear, greed, and temporal discounting (preferring immediate rewards over larger future benefits) work against wealth accumulation.

Automation bypasses these tendencies entirely.

Dr. Shlomo Benartzi, a behavioral economist at UCLA, developed the “Save More Tomorrow” program based on this insight. The program automatically increases savings rates following pay raises. Companies useing it saw average savings rates climb from 3. 5% to 13. 6% over four years-without participants feeling any lifestyle reduction.

The principle applies to personal automation as well. Scheduling small automatic increases-even 1% annually-compounds dramatically over time while remaining imperceptible day-to-day.

Wealth isn’t built through heroic acts of financial discipline. It accumulates through boring, consistent, automated behaviors repeated thousands of times. The sooner these systems get useed, the sooner the compound interest clock starts ticking.

And unlike willpower, compound interest never runs out.