The Best Apps for Tracking Your Investments

The Best Apps for Tracking Your Investments

Managing a portfolio across multiple brokerages, retirement accounts, and asset classes creates a logistical headache. Spreadsheets work until they don’t. And they stop working faster than most investors expect.

The investment tracking app market has matured significantly since 2020. What started as simple portfolio aggregators now offer tax-lot tracking, asset allocation analysis, fee monitoring, and retirement projections. Choosing the right tool depends on portfolio complexity, data privacy preferences, and whether manual entry or automatic syncing fits better into a workflow.

What Separates Good Trackers From Great Ones

Basic portfolio tracking requires pulling data from financial institutions and displaying holdings in one place. That’s table stakes. The apps worth paying for go further.

Real-time sync accuracy matters more than sync frequency. An app that updates every 15 minutes but misses 10% of transactions creates more problems than one updating daily with 99. 9% accuracy. Empower (formerly Personal Capital) and Kubera lead here, though both occasionally struggle with smaller credit unions and international brokerages.

Tax-lot tracking separates casual trackers from serious investors. Knowing that a position is up 40% overall means little when specific lots have different cost bases. Stock Events and Sharesight handle this well. The difference shows up at tax time-specifically when harvesting losses or choosing which lots to sell.

Fee analysis catches what statements obscure. A 2023 study from the Investment Company Institute found the average equity mutual fund expense ratio dropped to 0. 42%, but individual investors often hold funds charging 0. 80% or more without realizing it. Empower’s fee analyzer has helped users identify $23 billion in excessive fees since launching the feature.

The privacy question looms large. Account aggregation services require sharing login credentials with a third party. Plaid, Yodlee, and similar services sit between users and financial institutions. For investors uncomfortable with this model, manual-entry apps like Stock Events, Portfolio Performance, and Portseido offer alternatives. The tradeoff: more work, more control.

The Top Contenders, Ranked by Use Case

For Comprehensive Wealth Tracking: Empower

Empower’s free tier handles what most investors need. It aggregates accounts from over 17,000 financial institutions, tracks net worth over time, and provides retirement planning projections.

The investment checkup tool deserves specific mention. It compares current allocation against target allocation and identifies drift. For a portfolio spread across a 401(k), IRA, taxable brokerage, and HSA, this bird’s-eye view prevents accidental over-concentration.

Drawbacks exist. The app pushes hard toward Empower’s paid advisory services. Users with over $100,000 in tracked assets receive calls from financial advisors. Some find this helpful; others find it intrusive. The mobile app also lags behind the desktop experience in functionality.

Best for: Investors wanting a free, comprehensive dashboard who don’t mind occasional sales pitches.

For International and Multi-Currency Portfolios: Sharesight

Sharesight originated in Australia and handles international investing better than U. S - -centric alternatives. It supports stocks, ETFs, and mutual funds from over 40 exchanges globally. Currency conversion happens automatically.

The tax reporting stands out. Sharesight generates reports aligned with tax requirements in the U. S. , UK, Australia, Canada, and New Zealand. For investors holding VTI alongside international ADRs and foreign-listed securities, this eliminates hours of manual calculation.

Pricing runs from free (one portfolio, up to 10 holdings) to $29/month for the Expert plan. The free tier works for testing; serious users need a paid subscription.

Best for: Expats, international investors, and anyone holding securities across multiple countries.

For Privacy-Focused Manual Tracking: Portfolio Performance

Portfolio Performance runs locally on Windows, Mac, or Linux. No account linking - no cloud sync. Data stays on the user’s machine.

This open-source German application handles complex scenarios: multiple portfolios, different currencies, custom taxonomies for categorization, and detailed performance metrics including time-weighted and money-weighted returns. The learning curve runs steeper than cloud-based alternatives. But investors who master it gain granular control impossible elsewhere.

The import/export functionality accepts CSV, PDF statements from major brokerages, and direct connections to some European banks. U - s. users typically import via CSV from their brokerages.

Best for: Privacy-conscious investors comfortable with manual data entry and technical setup.

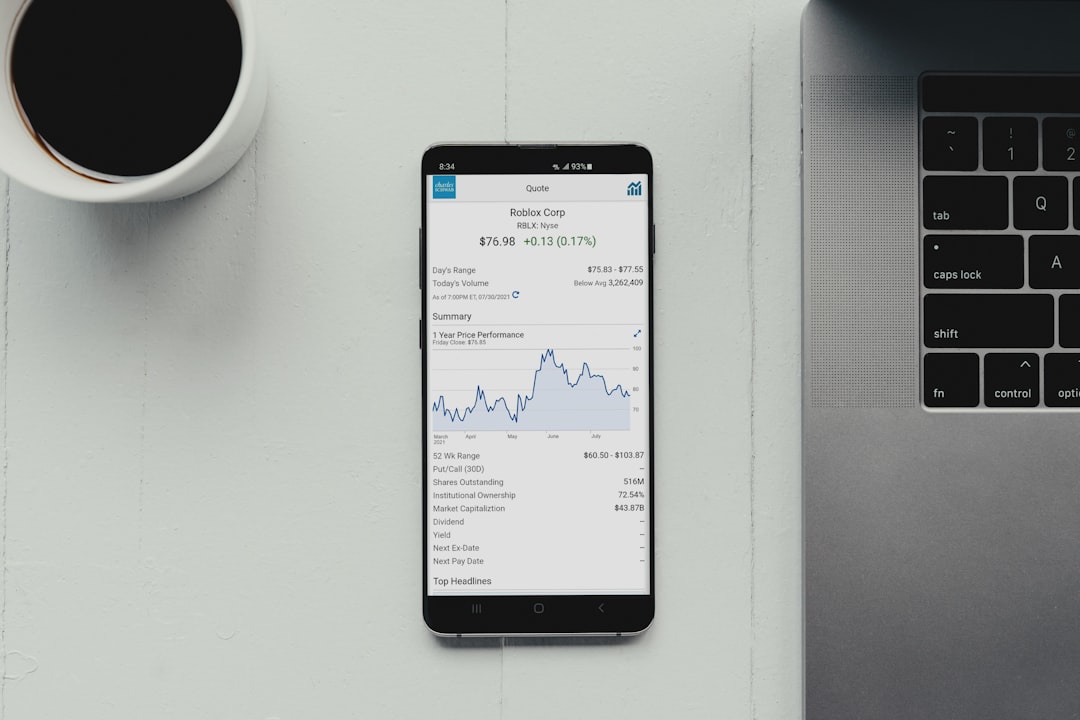

For Stock-Focused Active Traders: Stock Events

Stock Events tracks individual stocks and ETFs with an emphasis on corporate events. Earnings dates, dividend payments, stock splits, and SEC filings appear in a unified calendar. Push notifications alert users before market-moving events.

The app excels at what-if analysis. Adding a hypothetical position shows how it would affect portfolio allocation, dividend income, and sector exposure before executing a trade.

Pricing: Free tier covers basic tracking. Premium ($59. 99/year) adds unlimited portfolios, advanced analytics, and removes ads.

Best for: Active stock investors who want event tracking integrated with portfolio management.

For Dividend Investors: DivTracker

DivTracker focuses narrowly on dividend income. It projects future payments, tracks yield on cost, and visualizes income growth over time.

The FIRE community gravitates toward DivTracker because it answers a specific question: “How close am I to covering expenses with dividend income? " Monthly income projections based on current holdings make that calculation trivial.

Integration with Seeking Alpha and other research platforms adds context around dividend safety and growth history. The app costs $7 - 99/month or $49. 99/year after a free trial.

Best for: Dividend growth investors building toward passive income goals.

Hidden Costs and Common Pitfalls

Free apps monetize somehow. Empower uses free tools to identify high-net-worth prospects for advisory services. Others sell anonymized, aggregated data - a few display ads. Understanding the business model helps evaluate whether the value exchange makes sense.

Data accuracy degrades over time. Financial institutions update their systems; aggregators sometimes break. Schwab’s 2023 platform migration caused weeks of sync issues across multiple tracking apps. Investors relying entirely on automatic syncing discovered discrepancies only when manually checking. Periodic reconciliation against brokerage statements remains necessary regardless of which app handles daily tracking.

Over-monitoring creates its own problems. Research from Vanguard found that investors who checked portfolios daily traded more frequently and earned lower returns than those checking quarterly. The best tracking apps make monitoring easy-perhaps too easy. Setting designated check-in times rather than constantly refreshing helps avoid behavior that damages returns.

Making the Choice

The decision framework comes down to three questions:

**How many accounts and asset types need tracking? ** Simple portfolios (one brokerage, retirement account, and savings) work fine with any major app. Complex situations involving real estate equity, private investments, crypto, and international holdings narrow the field to Kubera, Empower, or manual solutions.

**What’s the privacy tolerance? ** Account linking through aggregators like Plaid is standard practice, but it requires trusting third-party security. Manual-entry apps sacrifice convenience for control.

**What specific features matter most? ** Tax-lot tracking, dividend projections, retirement planning, fee analysis-each app emphasizes different capabilities. Matching app strengths to investor priorities produces better outcomes than chasing the highest ratings.

Most investors benefit from starting with Empower’s free tier. It handles the common cases well and costs nothing. Those hitting limitations-international holdings, privacy concerns, specific analytical needs-can evaluate specialized alternatives against concrete requirements rather than abstract feature lists.

The goal isn’t finding the perfect app. It’s finding one good enough to provide clarity without creating busywork. Investment tracking should support decision-making, not become a hobby unto itself.